New ALS Investment Fund Partnership Seeks to Raise $100M to Accelerate Research

Written by |

A new ALS Association partnership with the ALS Investment Fund II seeks to raise $100 million in new funding to advance amyotrophic lateral sclerosis (ALS) therapy development.

This second venture fund follows one that originated in the Netherlands and raised $25 million in 2.5 years to support companies working to find ALS treatments and ultimately a cure. The partnership calls for the ALS Association to directly invest in the Fund.

“By investing in private start-up companies that are on the forefront of developing new ALS therapies, this fund will build on the momentum we have seen in ALS research since the ALS Ice Bucket Challenge and help move these efforts from the lab into the clinic,” Calaneet Balas, ALS Association president and CEO, said in a press release.

Comprised of collaborators in Europe and the United States, plus an expansive network of top ALS opinion leaders, the venture capital Fund invests in biotechnology companies specializing in neurodegeneration, particularly in ALS. In this partnership, with offices in Amsterdam and Boston, it will focus on diversified companies with robust pre-clinical data who are entering proof-of-concept and valuation inflection Phase 1 and Phase 2 clinical investigations.

The idea is to produce a mixed pipeline of treatment targets and approaches that will impede ALS progression. The new partnership also will support companies with platforms that enable therapeutic development beyond ALS.

“We are excited to leverage our experience and deep knowledge about ALS into a larger, second fund, are are pleased to be partnering and collaborating with the ALS Association,” said Felix von Coerper, managing partner of the ALS Investment Fund.

“We welcome broad participation and support from the whole ALS community — foundations, patients, and interested life science investors. We see this partnership as a cornerstone to creating a unique scaled vehicle to accelerate the translation of promising ALS therapeutics through clinical trials to patients,” he said.

“We are excited to apply the venture capital model to attract additional investment to ALS and accelerate drug development to patients, given the success of related venture models in advancing therapeutic development for other diseases, e.g. cystic fibrosis,” said Craig Boyce, another managing partner. “With all the general advances in medicine and the ALS-specific scientific progress over the last five years, now is an exciting time to invest in a diverse portfolio of ALS companies.”

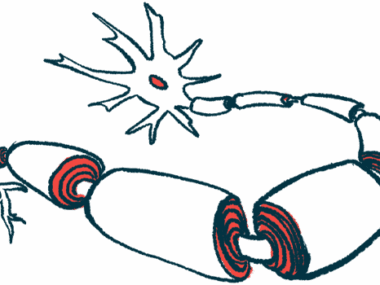

ALS is a progressive neurological disease that destroys nerve cells and causes disability. Globally, the average incidence rate of ALS is about one in 50,000 individuals annually.